Hello all, I hope you are well.

Firstly, thank you to all that have registered their interest in being part of the early release of the algorithm live dashboard. I didn’t expect so many people to sign-up so quickly 🙏 For the first 100 that applied, expect to receive a link within the next few days. 📨

Coinbase IPO tomorrow

Coinbase, the biggest US crypto-currency exchange, are set to list publically tomorrow, targeting a valuation of $70bn.

I will summarise the possible up and downsides to this IPO by quoting this FT article:

When the nine-year-old start-up lists on the Nasdaq exchange on Wednesday, it will become the first major cryptocurrency company to go public in the US, a milestone that has generated excitement in an already buoyant market for digital assets.

The challenge is that few people know how to value the company, which counts on volatile transactional revenues in lightly regulated markets for the vast majority of its business.

“It’s a bit of a Rorschach test for people’s belief in crypto,” said Tom Loverro, a partner at IVP, which valued the company at $1.6bn when it first invested in 2017.

What do I think?

Crypto is definitely here to stay, and while talks of a bubble are heating up as Bitcoin surges further, institutional investment means it’s a different beast to what it was in 2017. short-term? possible correction. Long term? 🌝

For Coinbase, while it’s a good growth prospect long-term, it will likely be over-hyped at IPO, I would wait a few weeks for a potential pull-back. If you’d like to read about an alternative investment to Coinbase, read my post from a few weeks ago👇

Nothing but NET 📈

CloudFlare (NET) partners with Nvidia (NVDA) to bring AI to its global edge networking.

I covered Cloudflare in my long term sector analysis a few weeks back, with the price up 18% since then, this is one I believe has bigger future potential still. If you’d like me to do some deeper analysis on this stock, drop me a comment below 👇

RIDE or die? 🛻

Lots of chatter happening over Lordstown Motors (RIDE), an EV truck company preparing to take part in one of the toughest tests for a truck, let alone an electric one, the SCORE San Felipe 250 off-road race this saturday.

A few interesting things to point out about this stock, including semi-autonomous production capability, GM financing and a new $3bn production plant, with a forecasted mass-production start date in September.

Expect big moves to the upside if this goes well.

Downsides?

Short-seller, Hindenburg Research, targeted $RIDE in a research report last month.

The general EV market has been taking a hit recently, due to worries around over valuation. While there has been some recovery recently, expect some more volatility in the short term.

If you would like some more in-depth bedtime reading around Lordstown, these two posts and investor presentation are a great start:

$RIDE with Lordstown – Huge catalyst this weekend and a chart ready for a break-out 🚀 🚀 🚀

Hitch a $RIDE to the Moon: Technical Analysis of Lordstown Motors

Containership stocks on the rise

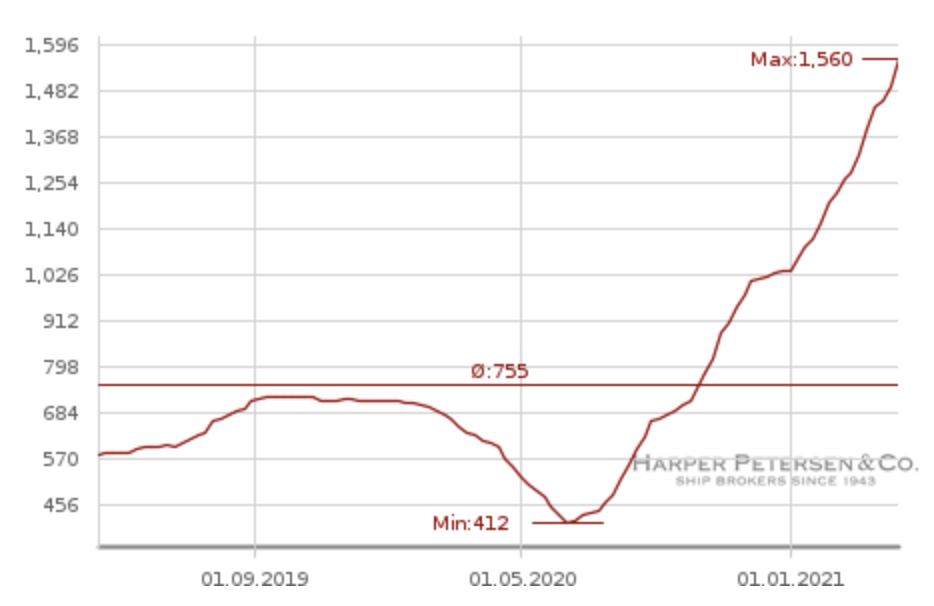

The rates for containerships (how much it costs to charter a ship of a certain size) has been rising rapidly recently, and that was even before the Suez canal incident.

You can track the latest rates, and how much they have recently risen here: container shipping rate tracker

It’s worth noting that the rates above are not just spot rates, but charters are being booked in for 2-3 years at these rates. Much of 2021 is already locked in for these companies and now looking at solidifying coverage into 2022-2023+

This implies strong income for containership shipping companies over the next few years, at a current time where their stock prices have taken a hit due to reduced demand arising from COVID-restrictions.

for those asking whether this demand will wane as supply catches up after COVID related surges fade, let me quote an extract from the original research which inspired me to look at this further:

Containerships were already in a massive upturn during 2019 and into the very start of 2020. Then COVID interrupted all this and rates briefly collapsed. Yes, port delays and other issues from COVID are helping keep rates higher, but this isn't just a temporary dislocation like tankers, the rates were already strong without COVID.

There is also a further read by the same author you can look at here:

Containership Boom: Rates Even Higher

Companies to look at for this opportunity?

Zim Integrated Shipping Services Ltd (ZIM)

the safer of the two options, a higher market cap and established customer base, but with less potential upside.Navios Maritime Partners LP (NMM)

The more risky option, but with higher potential upside.

Trending stocks to keep an eye on 🔎

Alibaba group (BABA)

BABA saw a big increase in share price after antitrust proceedings against it came to an end at the start of this week. This, along with orders by beijing to revamp its affiliate Ant group, have removed a lot of uncertainty around Alibaba group.

Murmurings of this news was picked up by the chatter algorithm last week, and has seen ever increasing chatter since then. Will the price increase further?Nvidia (NVDA)

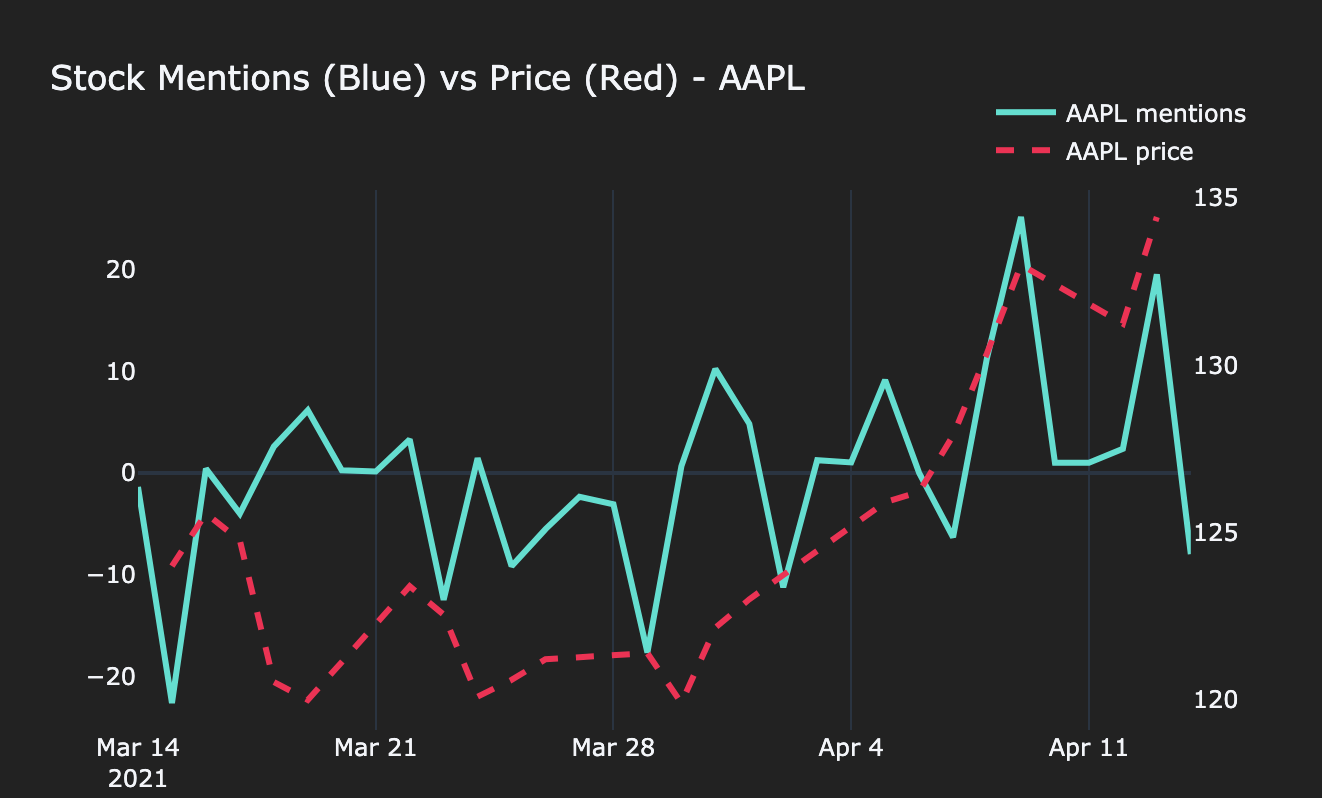

Partnership announcements with NET, news of a data-center focussed CPU targeting cloud technologies and upbeat Q1 earnings meant that NVDA has seen a big increase in price over the last week. This one is on my long-term radar.Apple (AAPL)

I have covered AAPL in the past, with a 13% move in price since. Expect bigger rises still, especially with upcoming product announcements on 20th April, Apple price tends to rally a few % after every positive product reception.

What are your plans for the week? are you involved in any of the plays I have mentioned? let me know by dropping a comment below