Hello all, I hope you had a great weekend.

This week’s roundup is later than usual, as I have so much to share with you this time. You have not one, but 2 stock researches, both of which have gone up %15 since I mentioned them last week, along with the usual summary of the most talked about and buzzing stocks (there’s a bonus graph!).

Another reason this edition has taken longer is because in the background, I am developing an interface for the tool which allow you to see the results of the top mentioned stocks in real time, along with host of other data. Subscribers to this free newsletter will have first access to this, so make sure to share and subscribe!

Now without further ado, let’s dig into the stocks for this week!

Voyager Digital Ltd. 📱🪙 (OTCQB:VYGVF)

TL;DR:

Positives:

Rapid growth

No commision crypto trading

growing market

Possible downsides:

Crypto security

OTC traded stock

Market Cap: $3.3bn

Voyager Digital is a Canada-based crypto-asset broker that provides retail and institutional investors with a turnkey solution to trade crypto assets. The Company’s platform uses a router and customized algorithms to allow users, either retail or institutional, to place and route trade orders to one or several trading exchanges to buy or sell cryptocurrency assets.

This is a similar offering to Coinbase, a crypto-currency trading provider in the process of offering an IPO valuing the company at $100bn, but with one major difference, Voyager charges no fees.

To give you a comparison, Coinbase can charge up to $80 on every trade worth $5000, with commissions ranging between 1.5-4.%

While Robinhood has started offering a similar service for crypto, and has a more established customer base, recent events regarding them restricting clients’ trading activities in relation to GME has seen Robinhood trust and user rating plummet, with many jumping ship to Voyager.

Growth

Over the last year Voyager has seen tremendous growth both in client numbers and Assets Under Management (AUM), this has been down to three main reasons:

Brand Awareness and increased visibility

Surge in crypto prices and hype

Competitor PR mishaps

This has meant that voyager has been able to see AUM growth from $230M in December 2020 to $1.7Bn in Feb this year, adding 400,000+ users in the process.

While it is unlikely this explosive growth will continue for the remainder of the year, an ever-increasing interest in Crypto means that there is still a tremendous market to tap into. Furthermore, Voyager is currently only available to US customers, however, Europe expansion is on the way, in the form of an acquisition of France-based digital asset exchange LGOUY.

Profitability wise, Customer acquisition costs have averaged from $20 to low $30s per new account. This is while monthly revenue per account has accelerated from $40 per month in 2020 to $80 per month in 2021. (You can read the full report here.)

Improved Offering

Voyager has some key offerings that make it stand out from competitors, namely:

Zero Commision trading

A wider selection of tokens to trade, compared to rivals such as Coinbase or Kraken.

Ability to earn fixed interest on stablecoins (this is a big section that I will not be covering here, if you are interested see this article)

Future plans of Credit & Debit cards, more akin to a normal bank

How does Voyager offer zero commision?

There are two ways Voyager currently makes revenue:

Smart Order Routing

When you place an order to buy or sell a cryptocurrency, Voyager provides a listed price that you accept. It then connects your order to 12 exchanges. Unlike securities, which by law must have the same price across all domestic exchanges, cryptocurrencies are priced at variable levels. In other words, the same coin can be listed at two different prices at the exact same time. Voyager uses this arbitrage to profit from the trade, which would be more than any commision or fee, essentially splitting those profits with you by providing a zero-cost trade.Banking Operations

Like a normal bank, Voyager uses the same asset for multiple derivatives. This is similar to how Robinhood make the user take on counterparty risk. Should Voyager become insolvent, you will need to stand in line behind other creditors to receive your money back.For taking on this risk, Voyager offers significant yield in a yield-starved economy. Like a bank, a minimal deposit must be kept to receive this interest payment, which can be as high as 9%. As part of this program, it may take up to 7 days for you to withdraw any crypto from your account.

It’s worth noting that Voyager does not have FDIC or SPIC insurance against your cryptocurrency deposit, only on the cash. (FDIC and SPICs are forms of deposit insurance meaning you will receive back your money in the event of a run on the bank or insolvency)

Possible downsides

There are already some massively more established competitors in this space, namely Coinbase, Robinhood, Kraken and Binance.

Crypto providers and exchanges still have some trust issues arising from historical hacks, most notably Mt Gox and Bitgrail, where users lost their cryptocurrency. Voyager was hacked recently in 2020, although no customer data or assets were stolen as the company shut its systems down upon discovering the vulnerability.

Voyager Digital is an over-the-counter (OTC) traded stock. OTC stocks come with higher risks as there are no central brokers compared to NASDAQ stocks, resulting in less liquidity. This means there is a possibility you will not be able to sell your shares straight away.

Summary

Voyager has been achieving tremendous growth lately, as people start becoming more aware of the brand and cryptocurrency trading in general. The company has some unique offerings which put it in a unique place in terms of customer proposition and revenue generation.

A naturally volatile stock given its crypto ties and its OTC listing, Voyager allows you a unique way to be exposed to the crypto boom.

Accsys Technologies Plc 🪵🏗 (AXS:LON)

TL;DR:

Positives:

Proprietary technology

Growing sustainable market

Completion of 2 production plants

Possible downsides:

Small market cap

Low debt-to-cashflow ratio

Market Cap: £272m

Accsys technologies PLC is a British based chemical technology company, specialising in production of high strength, long durability sustainable wood, for use as construction material.

The company produces two types of treated wood:

Accoya, used for windows, external doors, siding, decking, structural and civil engineering projects.

Tricoya, used for Facade cladding/siding and other secondary exterior applications; window components, door skins and wet interiors.

Accsys Tech has developed a proprietary method of “Acetylation”, a process which essentially pickles the wood, meaning the final product is much less susceptible to water absorption, shrinking, swelling, decay or insect attack.

Accsys sources all of its wood in a sustainable way, planting a tree for every one it chops down. The overall product and production process has a much lower emissions footprint than other building methods, with 1 cubic metre of Accsys wood locking away 1198kg of CO2 across its lifetime.

Sustainable treated wood has seen a surge in popularity recently, as construction and materials companies become more guided by environmental and sustainable drivers.

Future

The company is expanding to deal with growing demand for its product, and to extend its global reach, with 2 plants currently in development:

Accoya Arnhem Plant expansion - producing 60,000 cubic metres P.A.

Tricoya Hull Plant - producing 30,000 metric tonnes P.A.

This means the company is forecasting Annual earnings growth of 51%, higher than the industry average of 16.2%

Possible downsides

While the company has a healthy Equity-to-debt ratio of 0.42, Accsys’ debt is not well covered by current cash flow, at only 17% (the higher the better). This number will likely increase soon given expansion plans, but is something to be wary of.

The company has a small market cap of £270m, meaning lower liquidity and higher possible volatility in price.

Summary

An exciting blend of technology, traditional material and sustainability makes this a strong company to watch. Likely a long-term hold, with a small amount invested given its low market-cap.

Buzzing stocks of the week

This week has seen less chatter than usual on upcoming stocks, as the market wrestles with increasing treasury yields and inflation trends.

Most Buzzing

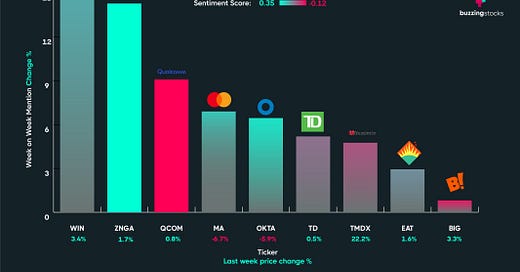

Below are the stocks identified by my AI algorithm as having the biggest shift in chatter, in terms of volume and sentiment over the last week. My algorithm purposely tries to avoid stocks that have seen irregular spikes in chatter, instead only identifying stocks with regularly increasing activity, to reduce the likelihood that pump and dump stocks appear on this list.

WIN has seen mixed chatter, as people are also confusing chatter on this stock with the gaming crypto token.

TMDX has seen rapid growth recently, following news of progress on it’s open organ therapy solutions (read more here)

TD has seen some solid growth lately, with banks in general seeing increased valuations off the back of news of increasing interest rates.

QCOM has seen mixed reviews, with people wrestling with worries that Qualcomm is rumoured to be dropped by Apple as they pursue in-house manufacturing, and excitement around the increased usage of 5G enabled products.

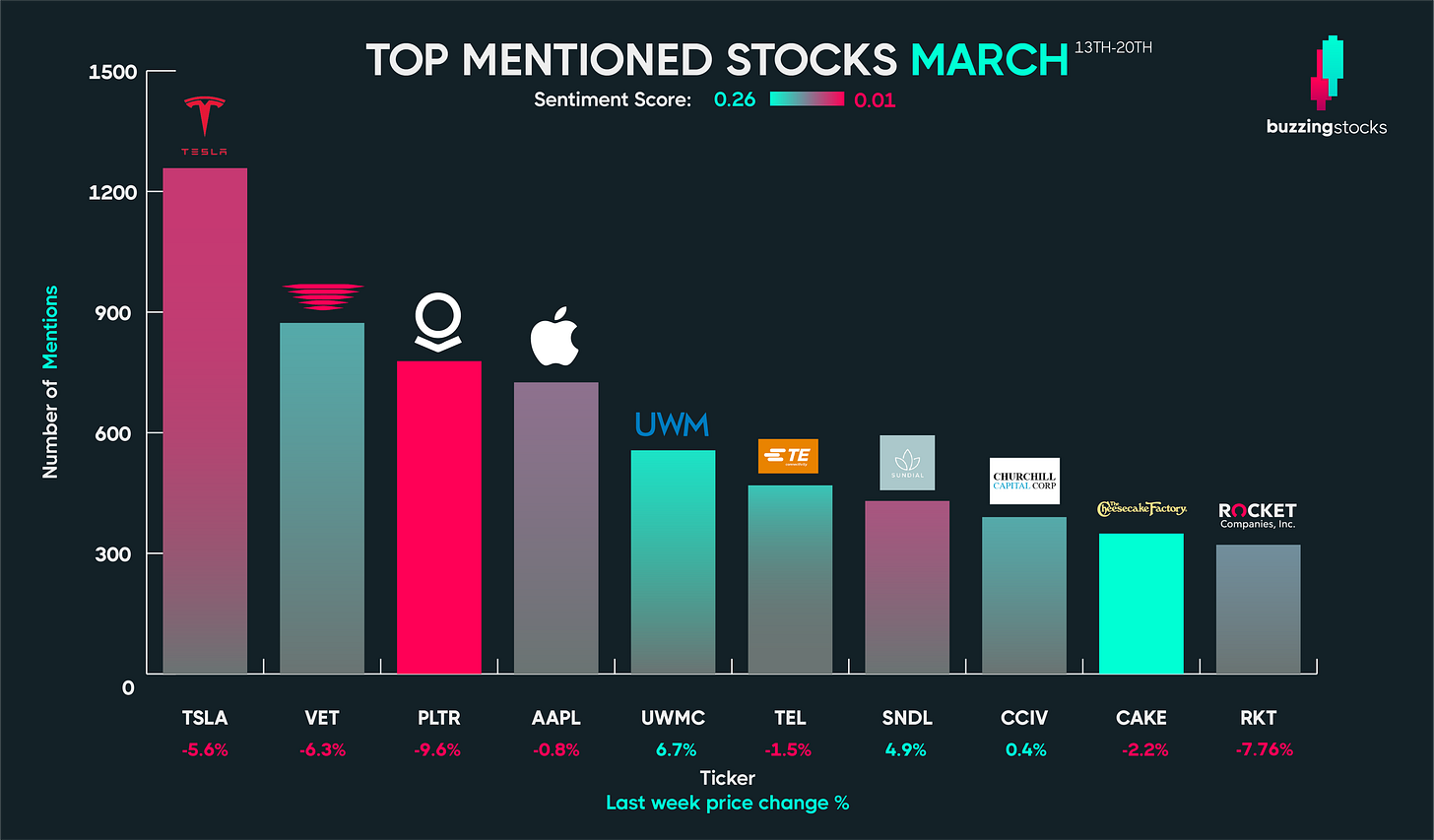

Most mentioned

Below are the stocks that has seen the biggest amount of chatter over the last week. It’s worth noting that my algorithm does some filtering to remove bot accounts from consideration, so the number may be lower than what other research houses quote.

the BANG family of stocks (BB, AMC, NOK, GME) have been filtered out due to their volatile nature, and they are covered extensively by other research houses.

The typical plays of this year are in there, including the ever present TSLA, PLTR and AAPL.

UWMC, SNDL and CCIV are the ones to keep an eye on this week.

What are your plans for this week? let me know in the comments below!

currently i am at learning stage, i have just started buying stocks on trading 212, are there any advice or headsup you can give, i would be very grateful

very much apprecite the fact that you are doing this for free, will you eventually start charging or will it coninue as Free?