Hello all, I hope you are having a great week!

Tech Earnings bonanza

This week has been mostly dominated by news of the tech giants destroying earnings, with AAPL, GOOGL, MSFT and TESLA comfortably beating analyst expectations.

AAPL actually saw a drop in its share price after the announcement, due to increasing concerns over the chip shortage that has been affecting manufacturers globally.

AAPL had already warned previously that the chip shortage would affect them, but that was previously more focussed on iMacs and ipads, rather than their flagship iPhone.

Here’s what NBC had to say around the matter:

iPhone shortages won’t doom Apple — it still expects slowing, “double-digit” growth over the $64.7 billion it reported in last year’s September quarter. But the admission shows that even Apple -- with its prodigious supply chain, operations-expert CEO, and purchasing power with suppliers, may have trouble getting parts it needs to meet demand amid a global shortage.

The buzzing take: A drop in share price for AAPL presents a good purchasing opportunity, as I remain massively bullish on the company’s long-term future, especially with increasingly poor showings from their android competitors and AAPL’s ecosystem ethos growing stronger.

Some big earnings announcements are still to come this week:

FB announcing results today, expect bumper earnings again.

ArcelorMittal (MT) will likely also show good results, as commodity prices have been on a rampage recently.

AMZN release their earnings on thursday, again I expect big earnings from extended AWS growth.

I am expecting strong results from Upwork (UPWK), the macro-labor trend of people leaving full-time office work and taking on more remote and freelance roles is growing stronger, and freelance organisation websites like Upwork will benefit from this.

Keep an eye on ExxonMobil (XOM) and Chevron (CVX) also, the rise in oil price will be beneficial for those companies.

given what we have seen from the market recently, expect a drop in price after good earnings, part of this is logical, people are already expecting companies like AAPL to beat earnings, and therefore it’s priced in already to a certain extent. The idea here is to use these earnings reports to assess longer term performance and investment opportunities.

What’s next for the markets?

I am seeing more and more warnings and articles around markets being near a ‘top‘. The infamous ‘Buffet Indicator‘, a measure of market health that looks at the ratio of US stock market valuation to GDP, has traditionally been used to call market highs and lows, is at its highest rate ever.

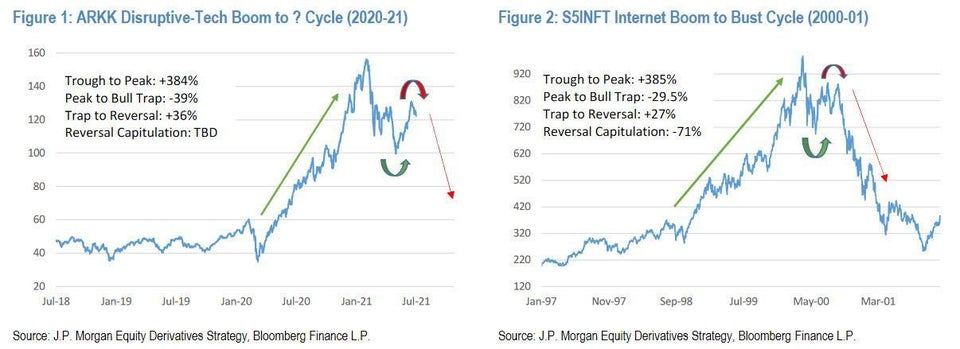

in other areas, this note from JP Morgan research notes:

"excessive speculation in high-growth sub-sectors year-to-date is causing ARK funds to exhibit market behavior (Fig. 1) similar to that witnessed during the dot-com bubble (Fig. 2)."

While we are near all time highs, it’s worth taking these warnings with a pinch of salt.

People have been calling an apocalypse every month for the last decade, and while some of the patterns here show strong correlation to past events, there is no reason to believe the past will repeat itself. History doesn’t repeat, but does rhyme.

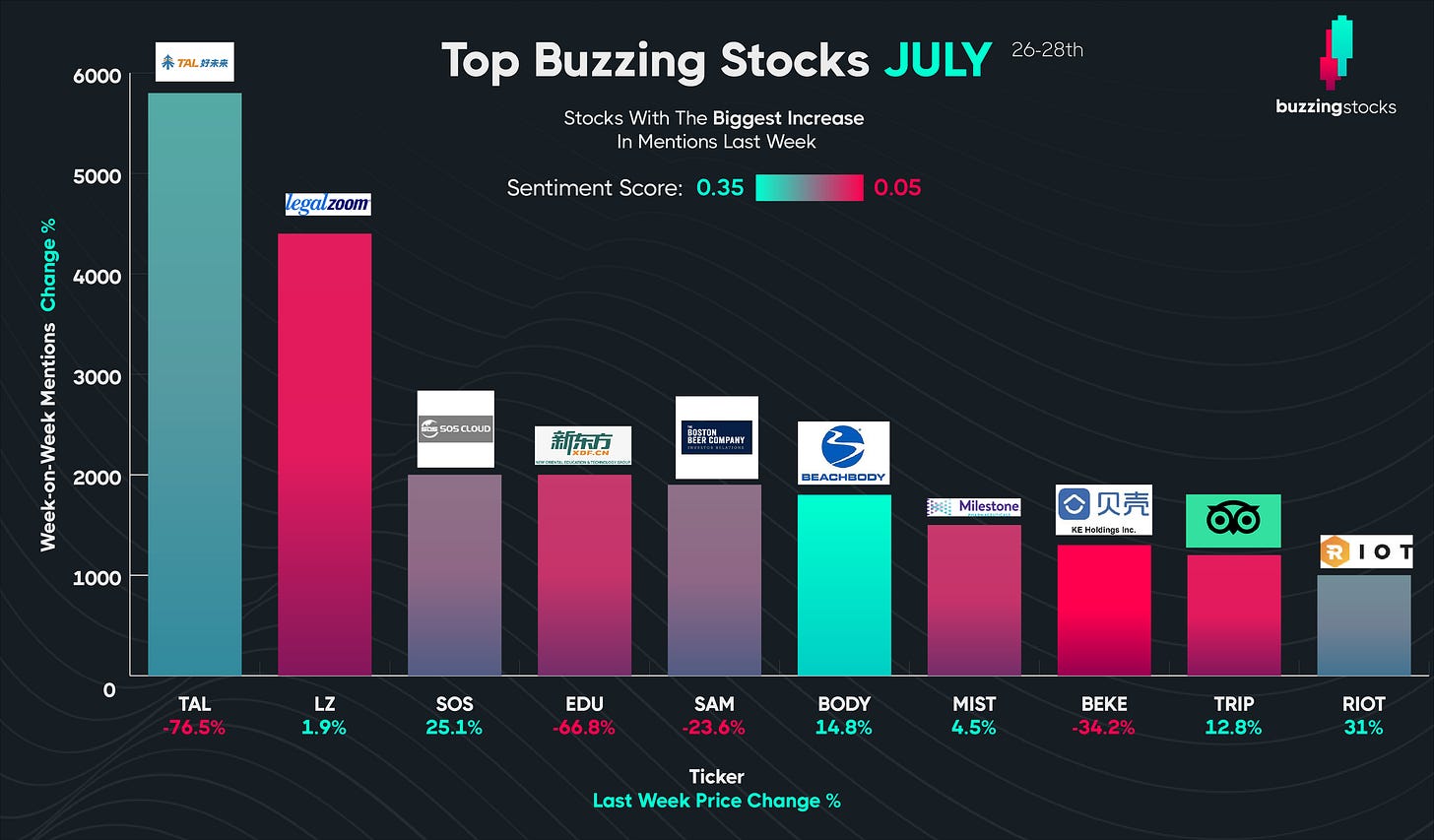

Buzzing stocks of the week

These are the stocks identified as having the biggest shift in chatter, in terms of volume and sentiment over the last week. The algorithm purposely tries to avoid stocks that have seen irregular spikes in chatter, instead only identifying stocks with regularly increasing activity, to reduce the likelihood that pump and dump stocks appear on this list.

Some crazy moves this week! A lot of chinese stocks in here, like TAL, EDU and BEKE. A ban on tutoring groups from making profits raises fears that no sector is safe from Beijing’s regulatory assault. The FT states:

Global investors sold $2bn of Chinese stocks on Monday as Beijing’s crackdown on education companies raised fears of more regulatory tightening across the world’s second-biggest economy. Offshore investors, who are mostly non-Chinese, were net sellers of Rmb12.8bn ($2bn) worth of Shanghai and Shenzhen-listed shares via a Hong Kong programme that lets them connect to mainland markets - the fastest pace of foreign selling in a year. Most of the shares they offloaded were picked up by Chinese buyers.

A lot of the chinese tutoring stocks are already starting to see some recovery, as investors look for buying opportunities at low prices, how much those stocks will recover remains to be seen.

SOS is one to be wary of, while it is up for the week, it has been on a long down-trend for the last few weeks.

RIOT is an interesting one to look at, the American based crypto-currency mining company offers an interesting exposure point to crypto. While the company has been on a downward trend since February, the current drop in interest in crypto (compared to the chaos a few months ago) could serve as a good purchase time for this stock…

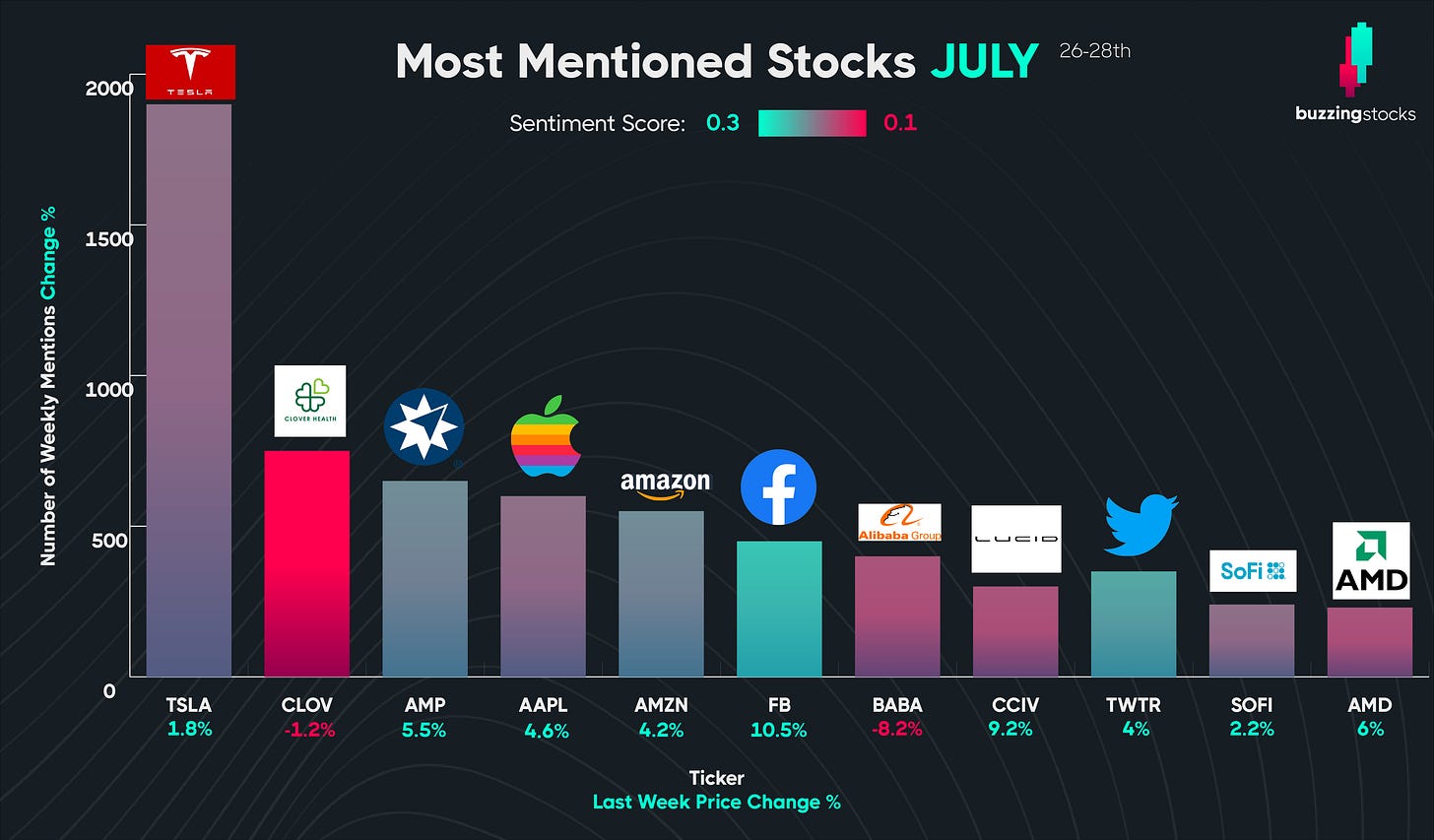

Most mentioned stocks of the week

These are the stocks that has seen the biggest amount of chatter over the last week. It’s worth noting that my algorithm does some filtering to remove bot accounts from consideration, so the number may be lower than what other research houses quote.

A lot of the familiar names are here, with TSLA leading the charge following their bumper earnings announcements.

An interesting note on GME and AMC, social media chatter has been polarised and subdued around the two companies, with many Reddit sites banning mentions of the ‘meme stocks’. I think a lot of new users have also started becoming bored of stocks, either having lost money or not seen the astronomical returns achieved by the lucky few.

AMP is a new addition to this list, I think a lot of the chatter with this has been around the AMP token.

SOFI is another new one to the list, the finance company having seen a big sell off along with SPACs throughout this year, with some seeing this as a good opportunity to enter into the stock at a low price.

Overall, not much massive movement outside of earnings announcements, partly as people focus more on summer holidays and sit tight to see where the pandemic plays out.

That’s all for this week! what are your moves for the week? let me know by dropping a comment below👇