The weekly round-up📰

Hey everyone! I hope you’ve been keeping well.

I haven’t been updating as much over the last week or so, as I’ve had a hectic couple of days, and investors have been caught up in the crypto buzz, meaning less chatter and interest in stocks.

I’ve had a few people messaging me, asking me for:

1. Expanding the live dashboard to look at crypto, or have a crypto only analysis page

2. Covering cryptos more in my writing.

While I’ll cover some major crypto events when talking about the investment landscape moving forward, I won’t be doing deep crypto research any time soon. I think there are lots of other people out there who cover and understand crypto much better than me, and I would like to stay focussed on stocks, as that is more my area.

The one word of advice i’ll have to people looking to invest in crypto is to have a strategy, and an aim for what you are trying to achieve. Have you researched the token or project you are buying into? do you understand the risks?

If you are looking to get rich quick on crypto by dumping a big amount of your money into an obscure coin, read this: My previous post on strategies like this, just swap "stocks" for "crypto"

The live dashboard

Firstly, I want to give a massive thanks for all of the testers over the last few weeks. You have noted and made great suggestions to me, all of which I will be looking into.

I think we are at a stage now where I can share the live dashboard with the world, and will be publishing the link to subscribers here first, so look out for something on this very soon!

Advice you should read if you are at the start of your journey

I came across a fantastic write-up on reddit the other day, Things I wish people had told me when I started investing, it’s worth a read to align yourself in terms of mentality.

TL;DR:

Always do your own due diligence. (I can’t stress this enough)

Use critical thinking for any single piece of information you read about a company or the market.

Stay open to criticism. If you have a good idea but someone knows better, it’s not just a learning experience but it can save you from losing your money.

Dollar cost averaging. It’s better to make several buys into a stock than one giant buy. It’s impossible to perfectly time the market.

Buy the dip but only if you have a good reason to! Don’t blindly buy every dip.

Don’t ever hesitate to cut your losses.

Never stop learning.

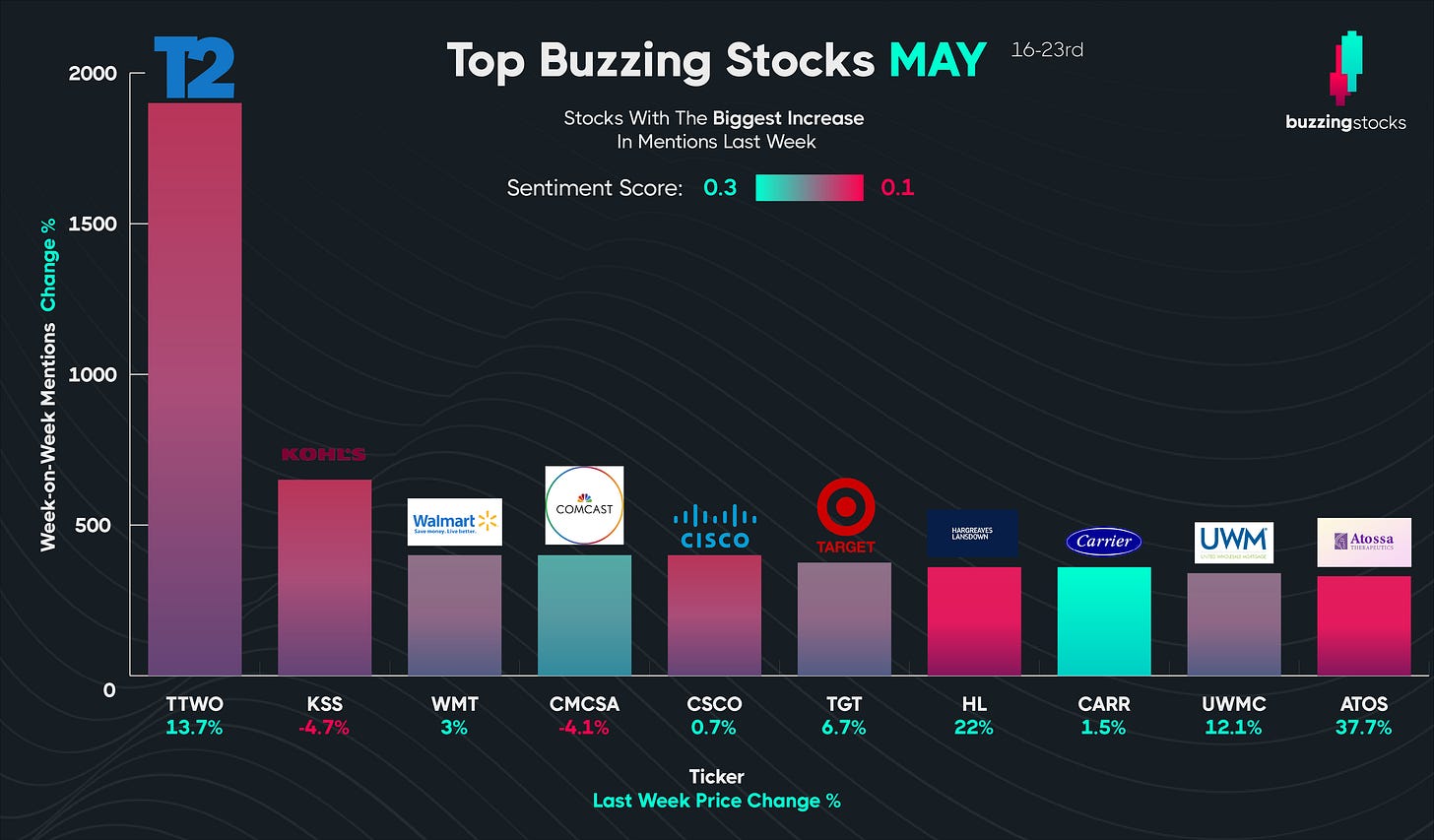

Buzzing stocks of the week

These are the stocks identified as having the biggest shift in chatter, in terms of volume and sentiment over the last week. The algorithm purposely tries to avoid stocks that have seen irregular spikes in chatter, instead only identifying stocks with regularly increasing activity, to reduce the likelihood that pump and dump stocks appear on this list.

A lot of mentions and price movements here are due to earnings reports.

Unsurprising to see cyclicals and retail doing well, as we see rotation away from tech and into re-opening affected stocks. I talked about this occurring back in early March, and I think the research there is still relevant, find it here: Rotation away from Technology

A few big movers to talk about:

Take-two interactive (TTWO) - video game publisher most famous for the Grand Theft Auto, Red dead redemption and 2K series, posted tremendous results for their Q4 results, with earnings boosted by people staying at home and playing video games. I am a massive believer in video games and surrounding products growing further in the future, E-sports for me has gained a new, sticky crowd last year that will likely to stay. Ask yourself how many streamers you know now vs last year. While Take-two could struggle to match this growth as places open up over this year, and GTA5 especially will be hard to replace, expect further long-term upside from them.

Kohl’s Corp (KSS) - The US department store also posted good results last week, yet saw its stock price tumble. A similar situation happened with CVS earlier this year, where I covered their stock at $69, now at $89, there could be a similar play here, especially as their revenues will only increase with re-opening stores.

Hargreaves Lansdown (HL) - The UK based investment services provider posted bumper earnings boosted by the retail investor mania of earlier this year. One of the few solid stock trading providers on the other side of the pond, especially towards more traditional and reserved investors.

Atossa therapeutics (ATOS) - Boy, what a rollercoaster this stock is. I mentioned back in March here: Atos 💊stock trending. currently undergoing trial approvals, be careful with this one, as it can move by a lot.

Most mentioned stocks of the week

These are the stocks that has seen the biggest amount of chatter over the last week. It’s worth noting that my algorithm does some filtering to remove bot accounts from consideration, so the number may be lower than what other research houses quote.

I will not go into specific stocks for this chart this week, given that there is nothing massively interesting to note in there. Tesla is unsurprisingly top as Musk has been everywhere with his Doge and Bitcoin talk. GME and AMC are still being talked about in a tremendous way, I don’t think that will go away soon, but I also don’t think much will happen too.

It’s worth noting that while LINK is a stock mentioned in here, I think that’s more referring to the crypto coin Chainlink, rather than the obscure $70 market cap company.

That’s all for this week! expect me to come back with some more in-depth research on sectors and stocks to go into. What are your plans for the week? let me know your below.