Hello all, I hope you’ve had a great weekend!

Firstly, for those that have signed up to the early-access trial, check your inbox, or spam folder if your link landed in there!

Crypto takes the charge

The big topic this week has been the incredible run crypto has had, with Dogecoin (DOGE) leading the way, rising over 700% in just the last few days, although it has come off its peak slightly since then.

Pretty much everything else in crypto land has been rallying heavily and reaching all time highs this year, with bitcoin up ~100% YTD (but down 14%, as rumours of margin accounts with 150x leverage are being blown up on binance, read more here)

With the way everything has been rising, talks of a pullback/crash/correction are naturally increasing, with people recalling the previous pullbacks of 2017 and 2014.

Could it rally further? absolutely, given that the visibility of BTC across the world is increasing, and more people are purchasing crypto to try and ride the wave. Furthermore, Crypto is now a completely different landscape to 2017, with so many more institutions now focussing and investing into crypto.

However, given how much crypto coins have rallied already, you would be unlikely to make the massive returns people have been posting online. I would wait for a pullback or correction, before thinking about investing, remember, don’t let FOMO get the better of you!

Naturally, as people’s attention has been diverted towards crypto, stocks have been getting less attention by retail investors, meaning less chatter and discussion online, therefore naturally, less stocks to discuss this week!

Stock market last week

S&P 500 was generally good last week, with growth, medical and tech stocks leading the way. Semiconductors struggled, as a chip shortage continues to bite, will be interesting to see how much of an effect this shortage has had, as more companies release their Q1 earnings this week.

World-wide, stocks have also seen good recovery. China has seen the worst performance, as investors weigh in more heavily on further antitrust litigation (which weirdly was the reason for the big rise in BABA price, as their case came to an end)

The UK markets have also performed well, as their economic outlook improves, thanks to a strong vaccine rollout programme.

Earnings in full swing

Q1 Earnings reports are in full-swing this week, and investors will be keeping a close eye to see the effects of inflations on bottom-line profitability.

Earnings will be the major focus for investors in the week ahead, as they home in on whether rising costs are squeezing margins and signaling a build in inflationary pressures.

So far, with one week in, companies are beating earnings estimates by a wide margin of more than 84%, according to Refinitiv.

Essentially, investors will be looking to see how profit margins are affected as companies start to ease out of lockdown, higher costs will drive prices further up, heating inflation, and vice-versa.

Most anticipated Earnings next week.

Earnings to keep an eye on:

IBM

Option traders are pricing in a 5.2% move on earnings and the stock has averaged a 4.8% move in recent quarters. For investors, the focus likely will be less on granular results and more on any new details the company provides on the planned spinoff of its managed information services business.The Coca-Cola Company

Option traders are pricing in a 2.9% move on earnings and the stock has averaged a 1.9% move in recent quarters. Coca-cola took a heavy hit during the pandemic as there was less demand for beverages with people locked in. Investors will be watching this one closely to see how they are recovering. Expect a slightly better than forecasted earnings.Johnson & Johnson

Heavily in the news recently as their vaccine has been suspended in the EU. Given the negative news around vaccines has been priced in now, I can’t see the price here going much lower. Option traders are pricing in a 2.5% move on earnings and the stock has averaged a 2.1% move in recent quarters. Expect an earnings beat.Snap Inc.

Option traders are pricing in a 14.9% move on earnings and the stock has averaged a 16.8% move in recent quarters. Still loss making, however Snap has been adding to its user base steadily, and found a good groove of digital advertising during the pandemic lockdown as more people turned to social media for entertainment. Snap has been volatile recently, and expect that to continue, you could take a small position to ride the earnings increase, but keep it small.Netflix Inc.

Option traders are pricing in a 7.3% move on earnings and the stock has averaged a 6.5% move in recent quarters. Netflix saw a big jump in user base last year as people found little else to do. Already at a very high Price-to-earnings ratio, it’s difficult to see how the price could rise further on announcement.Cleveland-cliffs Inc

Option traders are pricing in a 8.6% move on earnings and the stock has averaged a 5.9% move in recent quarters. Lots of chatter around the $22 level, meaning a big move up from $17.99 currently, although I haven’t had a chance to look into this one too much.Buzzing stocks of the week

Overall, less activity this week, as retail investors are more focussed on crypto.

Most Buzzing

Below are the stocks identified as having the biggest shift in chatter, in terms of volume and sentiment over the last week. The algorithm purposely tries to avoid stocks that have seen irregular spikes in chatter, instead only identifying stocks with regularly increasing activity, to reduce the likelihood that pump and dump stocks appear on this list.

HOPE is shining with lots of positive chatter. The Korean American bank has been trading sideways this month, but has seen it’s price gain over 40% YTD. While down from All-time highs of 22 in 2017, it has been steadily returning back there. Will it get back to those levels? let’s HOPE so.

FCX has rallied over 400% since March last year, and while the mining company can continue to grow further, it’s worth noting that it’s currently trading at a PE of 93…

BAND will be one to watch. having dropped 30% from all-time highs earlier this year, investors are now considering whether this is a good value stock now.

SPCE experienced gravity, and dropped massively on news of founder Richard Branson selling over $150m of shares. Expect some slightly positive moves this week as the news of SpaceX and NASA singing a deal add visibility to space stocks (also expect this to move TSLA’s stock price, as people tumble into the Musk-mania)

Most Mentioned

Below are the stocks that has seen the biggest amount of chatter over the last week. It’s worth noting that my algorithm does some filtering to remove bot accounts from consideration, so the number may be lower than what other research houses quote.

The usual suspects are in there, with little change compared to last week. More notable is the reduced sentiment compared to last week, as more people discuss having bought at the top in Feb, and seeing their portfolio in the red.

DKNG has just been named the official sports betting partner of the NFL, this is massive news, I expect this to raise the price soon as the news filters in, and their user base grows with this. Read more here

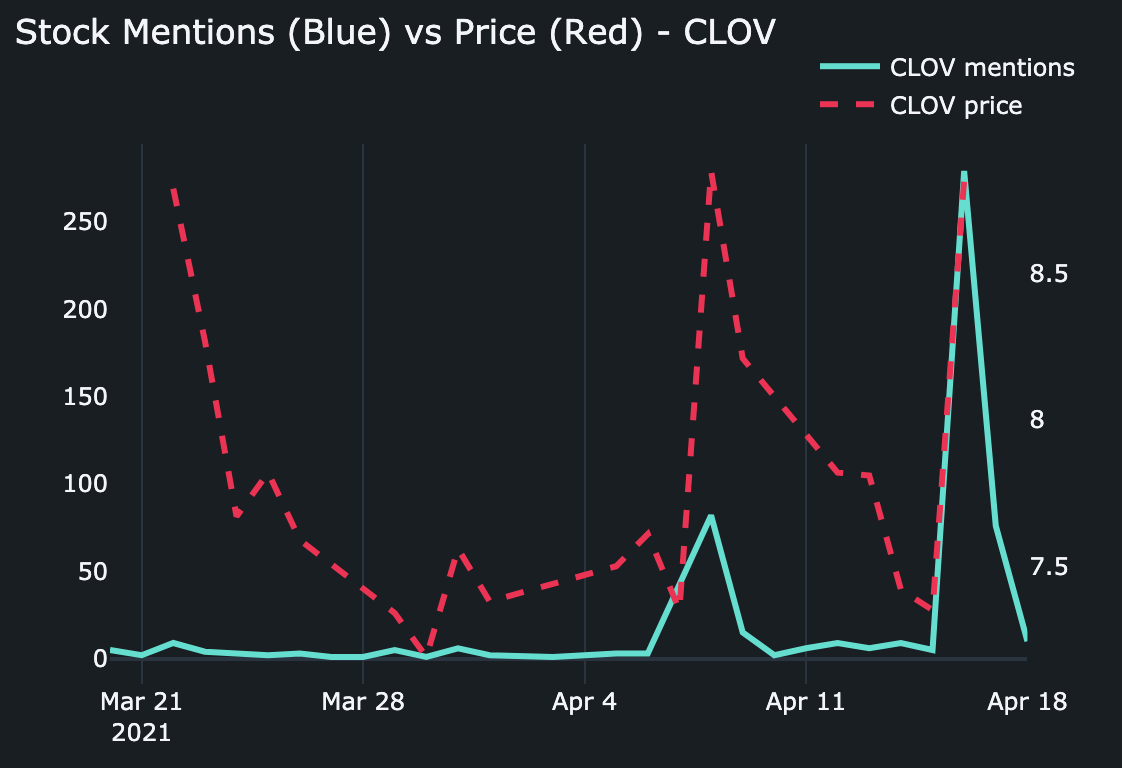

CLOV has seen major spikes in chatter (and price) recently, as the Chamath backed health company sees more discussion around a short-squeeze, similar to GME in January. Expect some more volatile moves this week, as the stock is up 5% in pre-market already.

SQ has made its way back into the top mentioned charts, as a recent rally from the end of March saw it gain over 30%. For me this is still a good term prospect, especially as COVID recovery will benefit their portable payment platform.

BABA is in there, as lots of chatter built up from their antitrust litigation last week.

That’s all for this week’s round-up folks! What are your plans for the week? let me know by dropping a comment 👇