The weekly round-up

Slumps, Sell-offs and Supercycles, and what the most hyped stocks have been

Weekly round-up

This last week has been more dramatic than most. Locally, the UK government announced the proposed roadmap out of lockdown, which sees June as a likely milestone to remove all restrictions.

This announcement is reflecting a larger market movement, where investors are thinking about life after lockdown, and what will happen to markets once people start moving about again, spending more and saving less.

So how did this affect the stocks last week?

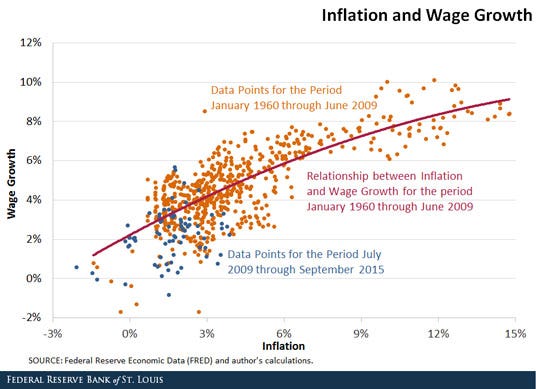

I will keep this explanation short (you can research more about it online, this can become quite a nuanced topic) but essentially, the thought process is that as the world returns to normal, industries open back up and economic growth increases, wages go up with it, demand for goods increases which drives the price of goods higher (we are already seeing this with the price of some commodities spiking); raising inflation.

The first place inflation changes are usually felt is in the bond market, inflation means money in the future is worth less (your £100 buys you less good in the future, compared to now) which means you need a higher interest rate (known as the yield) on the money you loan (the bond) to make it worth your while.

This reduces the price of current bonds (as they have low interest rates) which spooked investors and caused the sell-off last week.

This sell-off was also felt over in the stocks world, mainly affecting the tech-heavy growth stocks. Growth stocks are usually priced higher relative to the income they make compared to the rest of the market (Price-to-Earnings ratio) on the premise that they will grow and make a lot more money in the future. As this future money is now worth less due to inflation, their current stock price now suffers because of it.

The tech-heavy Nasdaq fell 3.5% last week, 1% further than the more tech-agnostic S&P 500.

What does this mean for the upcoming week?

At the end of last week, a $1.9 trillion stimulus package passed the US house, which means it can be voted on in the senate. Over the last year we have seen market rallies occur after stimulus packages being approved, as more money is pumped into the economy.

This could balance markets this week, and push some growth stocks further up.

Slightly longer-term, the improving COVID outlook could push the price of companies hit by the pandemic upwards (think airlines, holiday/hospitality, commodities/mining) as their outlook improves.

One thing to be wary of, is that the sell-off could continue onto this week, which will see the price of high growth stocks plummet further (personally, I enjoy times like this, as it presents opportunities to buy stocks at a lower price, with the caveat that I will have to hold on to them for long enough for prices to recover, therefore if you are thinking of doing this, please invest sensibly).

Most hyped stocks this week

Twitter

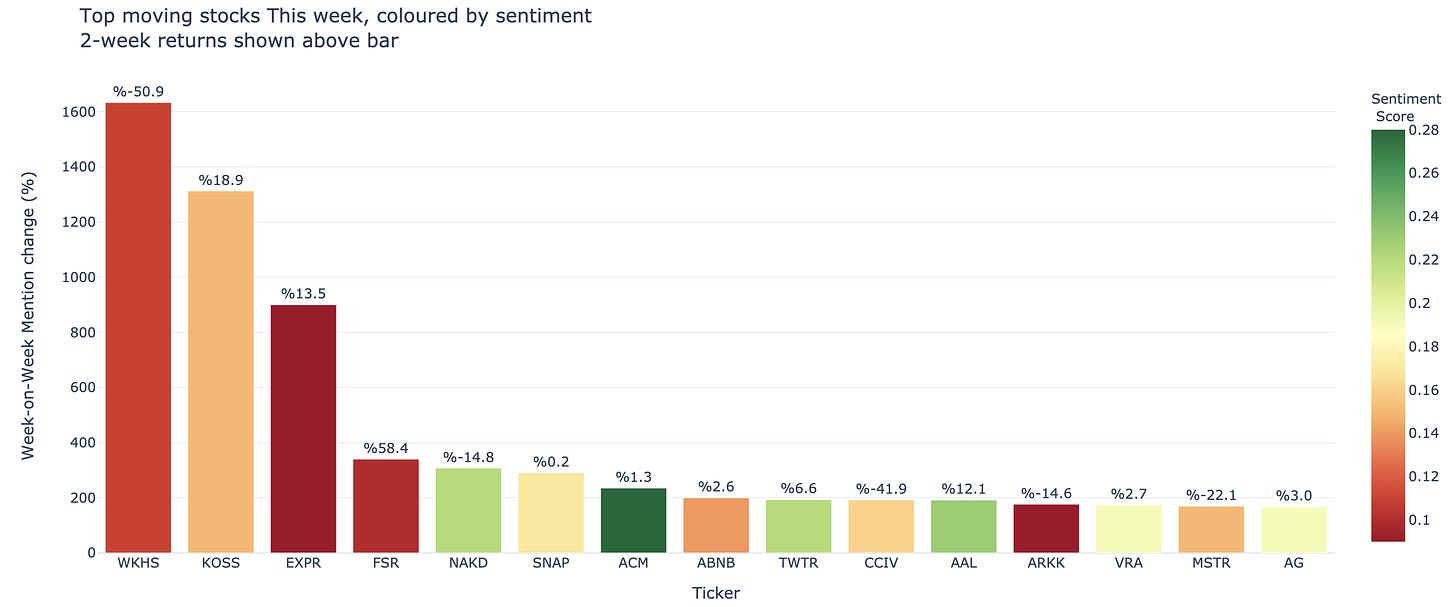

WKHS sees a dramatic increase in chatter this week, as it loses its USPS contract for Electric vehicle (EV) trucks (won by OSK)

KOSS is linked to the Short-squeeze stocks (GME, AMC, NAKD etc)

FSR spiked (both in chatter and stock price) as it released its Q4 results (be careful with EV stocks, they are very volatile currently)

The most interesting trend to take away from this (apart from another week of GME chatter) is the increased focus on recovering stocks, especially in the holiday space like ABNB, AAL (and others which are available on the full version of the tool) which have rising in chatter and sentiment over the last few weeks, suggesting some big moves soon.

Reddit

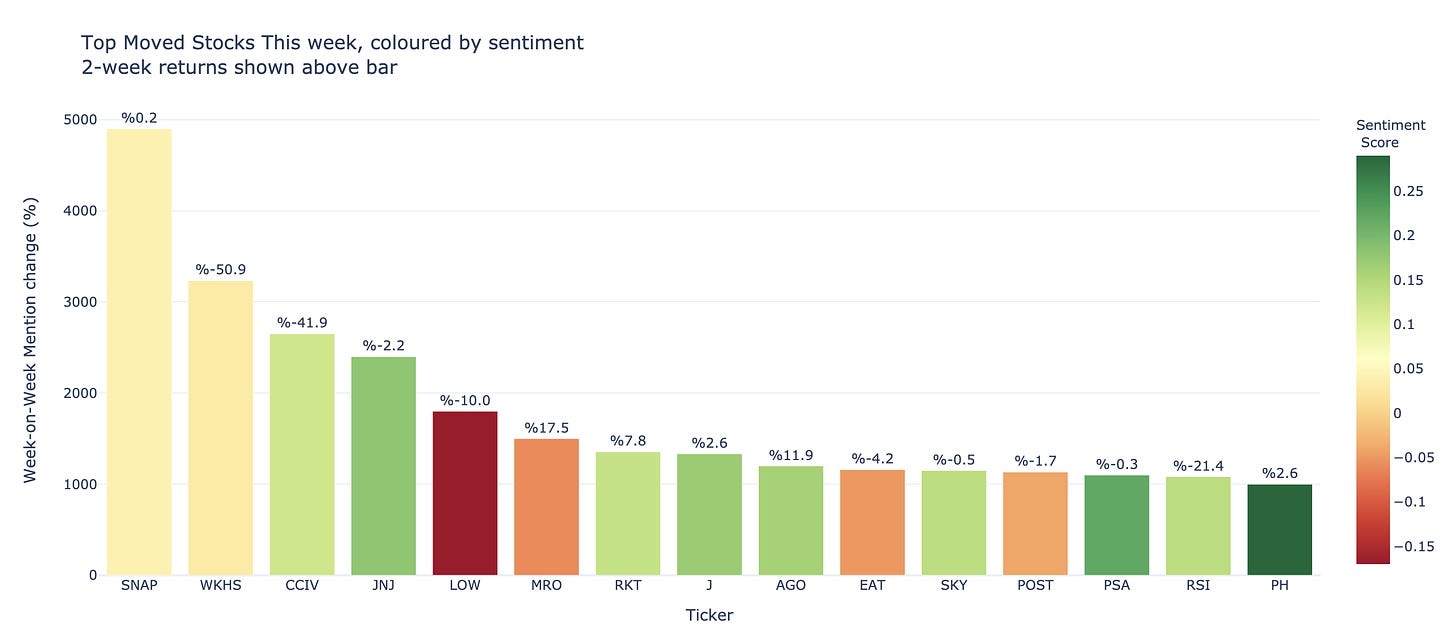

SNAP saw a big spike, as it announced very good earnings forecasts, but has been hit by the bond sell off, this could prove to be an interesting play

Similar chatter to Twitter in terms of CCIV and WKHS

JNJ is interesting, FDA have approved their vaccine for use, this could see some big moves on stock price soon

RKT is an interesting one, lots of moves especially since Q4 earnings update.

Reddit will be very volatile over the next week, as lots of chatter will be focussed on the recent spike in GME price. This means you need to react faster to the chatter if you want to make some returns of the stocks discussed.

Summary

I want to create a two way community here. Now that there are so many of you here, I would love to hear back from you to see which parts you enjoyed the most, and which parts you didn’t so much, so I can tune my content moving forward.

I am thinking about granting access to the results in real-time or on a more regular basis, followed up by some in-depth research later in the week, would you prefer this? let me know in the comments section below.

if you enjoyed this article, why not share it?

I am enjoying what you have done so far, and now I am a fan--so far! Keep up the good work, and thanks