The commodity super-cycle🧱🪵🪨

Earnings season, and what should you be rotating your portfolio into

Hi All, I hope you’ve had a great week.

Bumper Earnings

Earnings season is fully upon us, with many companies releasing their reports, and some big names have shown bumper results:

AAPL

Destroyed analyst expectations, reporting earnings per share (EPS) of $1.40 vs analyst expectations of $0.90. They also announced a share buy-back scheme worth $90bn and increased dividends by 7%. AAPL Still represents a solid buy from me, having covered them early last month. Read what I wrote about them here: Apple ResearchMSFT

Also beat earnings expectations, booking an EPS of $1.95 vs an expected $1.78, representing an annualised rental growth of 19% compared to last year. The big thing to call out from their earnings announcement is the growth of their cloud computing service Azure, growing by 50% last quarter. Cloud has still got a long way to go, and will only grow further. The massive benefit to MSFT is how well Azure integrates with other Microsoft office products, a big advantage to large corporates that are already microsoft based. MSFT traded lower after earnings, for me, if you want a low-risk investment, buy and hold.AMZN

Crushed earning expectations, reporting a first quarter increase in sales of 44% compared to last year, as more people turn to the e-commerce behemoth for shopping needs in lockdown. Net income more than tripled to $8.1bn in the same period.GOOG

During the pandemic, Google saw a revenue decline for the first time in its history, a 2% drop. To say Google made up for it this quarter is an understatement, upping revenues by over 34%, smashing in $17.9 billion of net income in the process. The one interesting part of their earnings filing for me was their cloud services, which are still a loss maker, even though that loss reduced compared to previous quarters.FB

You can see where this is going right? stock is up 6% after the company earned $3.3 per share vs the expected $2.37, mainly due to higher priced advertising.

What’s the point I’m making here? FAANG stocks have done tremendously well over the last few years, and these earnings only solidify their behemoth performances. While some of your portfolio should be allocated towards the big, steady earners, you should remember the cautionary tale of the “nifty fifty“, a group of outperforming stocks in the 70s which subsequently crashed in the 80s.

I still expect the hardware group of tech companies to do well in future (AAPL, MSFT, NVDA), advertising centric companies (FB, GOOG to a certain extent, TWTR) less so, as lockdown ending means people spend less time online, and the effects of Apple’s iOS 14.5 update, which makes it harder for adverts to track you across platforms.

What should you be looking at investing in instead then? glad you asked:

Commodities Super Cycle

Commodities go through large, multi-decade cycles. low supply —> Commodity prices rise —> more investment into supply —> over-supply —> price drops —> less investment until under-supply. Rinse and repeat.

In the past 227 years, there have been six peaks, the most recent in June 2008.

We were already starting to see effects of this before the pandemic, COVID simply accelerated this trend. We are seeing commodity prices rise, Copper, Uranium, Lumber, Steel and Corn have all seen tremendous price increases since summer lows, I expect more to come.

here is an extract from Janus Henderson around driving factors:

What are the factors driving the supercycle?

In China, rising infrastructure spending, rate cuts, more delegation to local governments to support the auto industry and some relaxation of housing policies are positive for metals demand. The copper price, which is often seen as a bellwether for global economic growth, has gained a massive 50% to US$3/lb since the lows in March 2020, while gold has set a new record high of US$2,000/oz (at the time of writing). Silver, rare earths and uranium are also emerging quickly from long slow periods and we believe other commodities are likely to follow.

You should think about allocating a part of your portfolio into assets affected by this supercycle, this will include:

Mining stocks - small market cap: STHC, LODE, SLSSF big market cap: GOLD, BHP, RIO

Uranium - There’s a fantastic video explaining this here, Uranium has been in a bear market for the last 10 years, however long term I am very bullish.While public sentiment is slowing down the rise, eventually the global warming crowd will realise nuclear is the solution to long-term energy supply. For me, this is a strong long-term play, won’t give immediate returns, but one to hold.

A few ETF and stocks to take advantage of here: URA, URNM, Uranium Royalty Corp (URC) , AAZ, CCJPrecious metals - still have some more drops to go through, but with inflation set to rise, people will increasingly look to precious metals as a value store. This has been the case with crypto this year, the digital precious metal.

Steel - price at an all time high, a few people have been shouting about this for a while, demand is only increasing. CLF, MT.

Oil - I get it, a dirty substance that harms the environment, and yes, long-term its in decline, as clean energy becomes more mainstream and economic. However, Oil is still in big demand in alot of production chains, and emerging markets are stepping up their demand for this. This one is probably the most contrarian view I have compared to the others.

Weekend Watchlist🔎

Here are a pick of stocks worth investigating further, as my algorithm has bubbled them up as trending with increasing chatter.

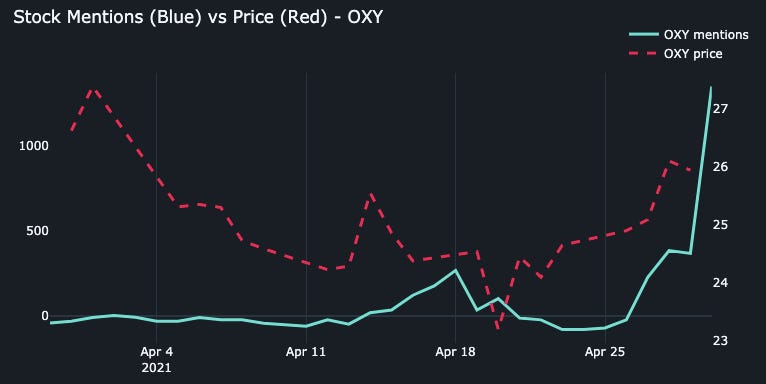

OXY

OSTK

FDX

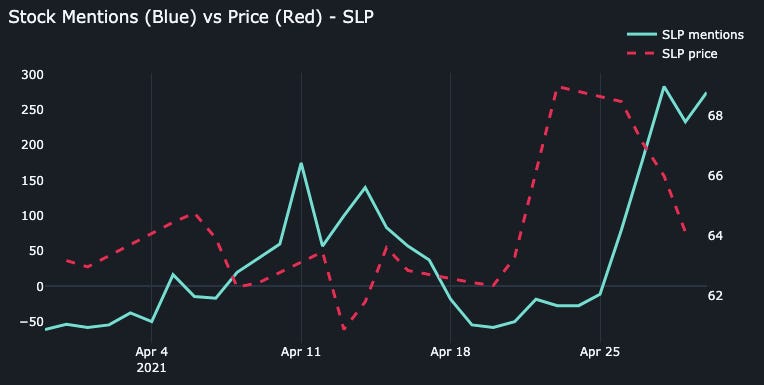

SLP

I will keep it short for this one, wanted to try a briefer style of article, what do you think of the shorter format? do you prefer it or would you like more in-depth research and commentary? reply to the email or drop me a comment below👇

Love the format and content -- great job!

I prefer this new format.

Will you at some point recommend buy prices for FAANG and also small/large cap stocks to day-trade?